Ignition Phase: Announcing the Mars Protocol lockdrop and MARS token launch

UPDATE: We’ve made several important changes to the lockdrop and token launch plan since the publication of this article. Please read the latest article for updated information: https://mars-protocol.medium.com/mars-distribution-plan-the-mars-token-launch-lockdrop-and-more-9f6d2dc0995c

IMPORTANT: This paper is subject to, and should be interpreted in light of, important disclaimers which appear at the end of this paper. Please carefully review those disclaimers, use the technology at your own risk, and do not rely on this paper for making any decisions.

MARS Governance Tokens

To succeed, Mars must become an open, decentralised, community-maintained financial commons. This requires giving all participants (users and builders) a governance system through which they can coordinate activity and decision-making so that Mars appeals to all of them. MARS tokens (and their staked version, xMARS) are an important piece of this puzzle.

By staking Mars tokens in the Mars DAO (also known as the Martian Council) and receiving xMARS, community members assume part of the value and the risks of the Mars smart contracting system.

The power of MARS

- xMARS provides voting power over Mars smart contract parameters and spending decisions regarding a decentralised MARS tokens treasury.

- xMARS rewards good governance with more governance power (additional MARS) and punishes poor governance with reduced governance power. Note that if the Mars smart contract system functions well, usage fees paid by users will accumulate, and MARS tokens will be automatically repurchased by the Mars smart contract system with these usage fees. If the Mars smart contract system does not function well, it may suffer shortfall events. In that case, staked MARS can be taken away from xMARS holders and given to users who suffered losses from the shortfall.

- Over time, because of how MARS is designed to be used within the Mars smart contract system, MARS and xMARS may become similar to decentralised shares in the value of the Mars smart contract system. This can also lead to MARS and xMARS gaining monetary value from the collective efforts of the community of Mars smart contract users and governance participants — however, because this result cannot be guaranteed, MARS and xMARS should initially be assumed to be completely valueless. MARS and xMARS can only gain value from participation by Mars smart contract users.

In order to align incentives, MARS tokens should be owned by those who build on or use the Mars smart contract system. Today, we’re excited to announce a plan for distributing MARS tokens to early users and kickstarting the Mars community.

The MARS lockdrop

A lockdrop is a way to fairly distribute tokens to early community members by allowing them to temporarily ‘lock’ one token (in this case, UST) in exchange for a reward in the form of another token (MARS).

To bootstrap the supply side of the TerraUSD (UST) credit pool, a lockdrop will be organised before the launch of the Mars Protocol. During a 14-day window deemed the Ignition Phase, users can lock/deposit UST at marsprotocol.io for a fixed duration (anywhere from 1 to 52 weeks).

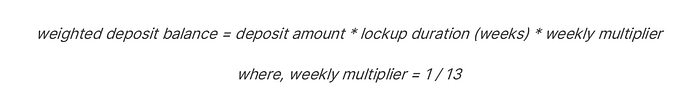

To reward participants who lock their UST for longer periods, a weight multiplier will be applied to their principal. This means users who deposit for longer periods will get more MARS tokens relative to those who deposit for shorter timeframes. Users can also make multiple deposits with varying lockup lengths. That is, they can lock x amount of UST for 1 week and y amount of UST for 52 weeks, etc.

During the first 12 days of the Ignition Phase, users who change their mind about participating in the lockdrop will be able to withdraw their UST (though doing so means they will not receive MARS tokens). On the last two days of the Ignition Phase, the withdrawal function will be disabled. Users will still be able to deposit additional UST in the lockdrop pool at this time, but they will not be able to remove their UST from the lockdrop until their individual selected lockup period expires. This period where withdrawals are disabled is intended to prevent an angle for unfair gaming where whales could deposit a large amount early on to discourage further deposits, only to withdraw most of their deposits at the last moment.

At the end of the Ignition Phase (23:59 UTC on Day 14 of the Ignition Phase), the MARS distribution is calculated on a weighted, pro-rata basis against each lockdrop position, and MARS tokens will become claimable by lockdrop participants.

Upon conclusion of the Ignition Phase, several things will happen:

- Each lockdrop depositor will be able to claim MARS tokens calculated on a weighted pro-rata basis based on their UST amount and selected lockup period

- The lockdrop depositors will become Red Bank ‘lenders’ — i.e., all locked UST will be transferred to the Red Bank and can be ‘borrowed’ by Mars users through the Red Bank.

- In addition to the MARS claimable immediately due to participation in the lockdrop, as ‘lenders,’ the lockdrop depositors — like all other Red Bank ‘lenders’ — will also receive xMARS which accrue per block over their UST deposits in the Red Bank. This means that users who participate in the lockdrop will receive both MARS (claimable all at once upon conclusion of the Ignition Phase) and xMARS (accruing per block for as long as UST remains deposited in the Red Bank with a minimum period equal to the selected lockup length). Users who deposit UST directly in the Red Bank (i.e., who are merely ‘lending’, not also participating in the lockdrop) will only receive xMARS tokens on their deposits.

- As Red Bank ‘lenders,’ lockdrop participants will also receive additional UST as ‘interest’ on their locked UST.

When a participant’s lockup expires, the participant can terminate their lockdrop. Upon terminating their lockdrop, they will receive maUST tokens redeemable for their initial UST deposit plus any ‘interest’ that accrued on such UST during the term of the deposit.

NOTE: There is a risk of partial or total loss of the UST tokens, and payment of ‘interest’ is neither contractually promised nor guaranteed. Please see the disclaimer at the end of this article.

In total, up to 2,500,000 MARS Tokens (2.5% of the total MARS circulation of 100,000,000) will be distributed to lockdrop participants. The exact number of MARS tokens participants will receive depends on two key factors:

- The length of the lockup (the longer a user locks up their UST, the more MARS they’ll receive)

- The total amount of UST deposited during the Ignition Phase

MARS tokens are being granted to lockdrop participants because they are willing to make a commitment to be early ‘anchor users’ of the Mars smart contract system for a certain minimum period of time. To whatever extent MARS or xMARS might ultimately acquire monetary value, one can think of such value as being given to lockdrop participants as a discount or rebate on system usage fees. To whatever extent lockdrop participants choose to stake their MARS for xMARS in order to help govern the Mars smart contract system, one can think of such governance power as being given to the most committed users because they are among those best positioned to understand Mars’s risks and benefits and safekeep their own committed funds by participating in Mars governance.

However, lockdrops aren’t without risk. As with any DeFi protocol, smart contracts can be subject to unforeseen vulnerabilities, as a result of which lockdrop participants’ locked UST could be subject to partial or total loss. Mars will undergo two security audits before launch in an attempt to discover vulnerabilities, but audits are not a guarantee of a lack of vulnerabilities or security of funds.

Ultimately, the Mars lockdrop will distribute governance power to the community that will govern the Mars smart contract system.

The Mars lockdrop is phase 1 in a radical experiment with the future of money. Standby for more detailed updates as the Mars lockdrop date approaches.

Join the mission to Mars

- Litepaper: Medium

- Newsletter: transmission.marsprotocol.io

- Telegram: t.me/martiannews

- Twitter: twitter.com/mars_protocol

IMPORTANT DISCLAIMERS:

Authorship of this Paper. This paper has been authored by Pythia Orbiter 1, a Cayman Islands LLC, as the vehicle for a joint venture developing the Mars technologies (the ‘Mars Joint Venture’).

Lack of Centralised Management. Consistent with the goals of community governance described here and in the Mars LItepaper, after the public launch of Mars, the Mars Joint Venture should not be expected to have a material ongoing role in Mars maintenance, research, development or promotion; nor does the Mars Joint Venture plan to raise Mars-related funding after the Mars launch date. The Mars Joint Venture may, in its sole and absolute discretion, elect to undertake limited ministerial activities directly or indirectly related to Mars, such as maintaining availability of the Mars web interface originally created by the Mars Joint Venture, but no promise, guarantee or assurance of such ministerial efforts or any other efforts is being made, and the Mars Joint Venture may abandon them at any time. The Mars Joint Venture has no long-term business or funding plan after launching Mars, and may cease operations or be wound-up, liquidated or dissolved by its members at any time. The Mars Joint Venture is not making any representation, promise, guarantee or assurance that any MARS it retains for itself or reclaims from grantees or any funding or resources it otherwise has or obtains will be held, used or spent for the benefit of the Mars community. Any sale or other transfer or distribution of MARS or xMARS tokens by the Mars Joint Venture could occur without warning. Any such transaction would increase the circulating supply of MARS or xMARS tokens. Depending on the number of tokens sold, transferred or distributed, the terms of sale, transfer or distribution and the prevailing market conditions, such a sale, transfer or other distribution could have a material adverse effect on the price or value of, or demand for, MARS or xMARS tokens. Any use of MARS or x MARS by or in connection with the Mars Joint Venture could also affect governance outcomes. The Mars Joint Venture is not promising to participate in governance or, if it does participate in governance, to vote in any particular way, and participants in the Mars Joint Venture who receive MARS or xMARS may exercise their own governance powers in their own independent discretion. As a result of the foregoing factors, there could be disputes, disagreements or a lack of coordination among the Mars Joint Venture and its participants or any of such persons and other MARS or xMARS holders or Mars users, which may adversely affect governance results.

Nature of this Paper. This paper is only a presentation of information, ideas and speculation regarding possible technologies, the possible uses of those technologies and a possible community of users and builders of those technologies. The statements contained in this paper do not provide any advice, representation, warranty, certification, guarantee or promise relating to these technologies, any uses thereof or any of the other matters discussed in this paper, nor does this paper provide an offer or agreement to make such technologies available, maintain or update such technologies, or sell or buy any asset or enter into any transaction. This paper and the matters described in this paper have not been reviewed, approved, endorsed or registered with any regulator or other governmental entity, and the authors of this paper are not licensed by any regulator or other authority to provide any legal, financial, accounting, investment or other advice or services.

Forward-Looking Statements. The forward-looking statements in this paper are subject to numerous assumptions, risks and uncertainties, and thus the events described or predicted therein are subject to change or to fail to occur in accordance therewith. We undertake no obligation to update, supplement or amend any statement that becomes inaccurate or incomplete after the date on which this paper is first published, or to alert the public as to any such inaccuracy or incompleteness, whether such inaccuracy or incompleteness arises as a result of new information we receive, changes of our plans, unanticipated events or otherwise.

Technology Risks. The technologies and assets described in this paper are highly experimental and risky, have uncertain and potentially volatile value, and should be directly evaluated by experts in blockchain technologies before use. Use them solely at your own risk. You should not rely on this paper as a basis for making any financial or other decision.

Metaphorical Use of Financial Terms; Lack of Legal Recourse for Funds. When used in connection with Mars, the terms ‘debt,’ ‘lend,’ ‘borrow,’ ‘collateral,’ ‘credit,’ ‘leverage,’ ‘bank,’ ‘borrow’, ‘yield,’ ‘invest,’ ‘money market’ and other similar terms are not meant to be interpreted literally. Rather, such terms are being used to draw rough, fuzzy-logic analogies between the heavily automated and mostly deterministic operations of a decentralised-finance smart contract system and the discretionary performance of traditional-finance transactions by people.

For example, ‘debt’ is a legally enforceable promise from a debtor to a creditor to pay an interest rate and eventually repay the principal. Therefore, ‘debt’ cannot exist without legal agreements and cannot be enforced without courts of law. By contrast, with Mars, there are no legal agreements, promises of (re-)payment or courts of law, and therefore there are no debts, loans or other traditional finance transactions involved.

Instead, Mars consists of software (including embedded game-theoretic incentives and assumptions) through which people can share their tokens with other people or smart contract systems and, under normal and expected conditions and subject to various assumptions regarding the behavioral effects of incentives, probably get their tokens back eventually, plus extra tokens, most of the time or in most cases. Unlike in traditional lending, the ‘lender’s’ financial return does not depend primarily on the creditworthiness, solvency or financial skill of the ‘borrower’ or on legal nuances such as the perfection of liens or the priority of creditor claims in a bankruptcy — it depends primarily on the incentive model assumed by the software design and how reliably the software implements that model. Unlike a debtor, people who ‘borrow’ tokens from the Mars smart contract system are not required to and have not promised to pay the tokens back; if the ‘borrowers’ never pay the tokens back, no promise has been broken, no legal agreement has been breached and the token ‘lenders’ cannot sue the ‘borrowers’ to get their tokens back. Instead, by not repaying the borrowed tokens, the token ‘borrowers’ merely demonstrate either that they lacked sufficient incentive to want to do so — for example, because their smart-contract-bound ‘collateral’ was worth much less than the ‘borrowed’ tokens — or that a technical issue — such as congestion of Ethereum — prevented them from doing so. Regardless, the ‘borrowers’ do not have an obligation to repay tokens when they do not want to or cannot do so, and there is no legal remedy for damaged ‘lenders’ when insufficient incentives or technical problems result in a token shortfall.

When Mars is used to ‘lend’ tokens to a third-party smart-contract system, the situation is even less like traditional debt: The ‘borrowing’ smart contract has not posted ‘collateral’ and could malfunction or suffer a loss that results in complete or partial failure to return the ‘borrowed’ tokens to the Mars smart contract system and its token ‘lenders’. In this case, the token ‘lenders’ could suffer loss of tokens, but they will not have a legal remedy against the ‘borrowing’ smart contract or the Mars smart contract. Smart contracts are not persons, are usually not under the full control of any person or group of persons and may be impossible to repair, debug, update, pause or reverse. A malfunctioning, exploited or underperforming smart contract cannot be forced (in court or otherwise) to pay the ‘borrowed’ tokens back.

The Mars protocol incentivises MARS holders to provide a potential partial remedy to token ‘lenders’ when token ‘borrowers’ fail to pay their tokens back — MARS holders who stake MARS in the Mars Safety Fund’ can increase their share of the economic benefits of the Mars smart contract system. Assuming MARS holders adequately respond to this incentive and that MARS has monetary value, the Mars Safety Fund can be used to partially or completely compensate Mars token ‘lenders’ who suffer shortfalls when token ‘borrowers’ fail to repay tokens or the value of ‘borrowers’’ liquidated collateral is too low. But, remember: the Mars Safety Fund, like the Mars credit protocol, is merely a smart contract, not a person or insurance company — if the Mars Safety Fund fails to provide MARS to the damaged token ‘lenders’, or if MARS have insufficient monetary value to compensate for such damages, there has been no breach of a legal agreement and the damaged token ‘lenders’ will not have a legal remedy.

Any rate, APR, APY, ‘yield’ or ‘interest rate’ stated in connection with Mars for lending, borrowing, depositing, staking or otherwise transacting in a given token, strategy or smart contract system, (the ‘Rate’) is denominated in terms of a specific relevant token, not in terms of U.S. Dollars or other fiat currencies. Each Rate is a forward-looking projection based on a good faith belief of how to reasonably project results over the relevant period, but such belief is subject to numerous assumptions, risks and uncertainties (including smart contract security risks and third-party actions) which could result in a materially different (lower or higher) token-denominated rate, APR, APY, ‘yield’ or ‘interest rate.’ Rates are not offers, promises, agreements, guarantees or undertakings on the part of any person or group of persons, but depend primarily on the results of operation of smart contracts and other autonomous or semi-autonomous systems (including third-party systems) and how third parties interact with those systems after the time of your deposit. Even if a particular projected Rate is achieved, you may still suffer a financial loss in fiat-denominated terms if the fiat-denominated value of the relevant tokens (your deposit and any tokens allocated or distributed to you pursuant to the Rate) declines during the deposit period. Projected Rates are not interest rates being paid on a debt.

Thus, the transactions you can perform by using the Mars ‘credit protocol’, although they are superficially similar to traditional financial transactions in some ways, are in fact very different. ‘DeFi’ and ‘TradFi’ each pose their own unique set of costs, benefits, risks and protection mechanisms. Please bear this fact in mind when reading about Mars, and do not use Mars without a sufficient understanding of how doing so differs from traditional financial transactions. The only way to fully understand such factors is to have a strong understanding of the relevant technical systems and the incentive design mechanisms they embody — we strongly encourage you to review Mars’s technical documentation and code before use.