Introducing Mars Protocol’s Risk Framework

Update on January 18, 2023: This risk framework has been deprecated in favor of a new Mars Protocol Risk Framework designed specificially for Mars v2. The new risk framework is available here: https://blog.marsprotocol.io/blog/introducing-mars-protocols-risk-framework-2-0

The Mars Risk Framework serves two main purposes:

- Assessing the riskiness of assets to be added to the platform; and

- Based on that assessment, setting the risk parameters for those assets.

In this post we’ll explore how this framework works in detail. In the first section we’ll define the categories and variables that we measure to assess the riskiness of an asset. Then we dive into the methodology we use for scoring these assets and lastly, we explain the process we use to set the protocol’s risk parameters.

Risk categories and measured variables

The Risk Framework evaluates assets in 3 main categories:

- Market Risk: Measures the liquidity and volatility of the asset.

- Smart Contract (SC) Risk: Measures the riskiness of the asset at the technical layer.

- Counterparty (CP) Risk: Measures the centralization risk of the asset.

Each of these categories, in turn, is measured through the following variables:

Market Risk:

- Maximum intraday drawdown: Maximum price change (from high to low) in a trading day over the last 365 days.

- Volatility: Standard deviation of the logarithmic daily returns over the last 90 days.

- 24hr volume: Average 24hr volume over the last 90 days.

- Worst 7-day volume: Minimum 7-day average 24hr volume over the last 90 days.

Smart Contract Risk:

- Time since launch.

- Honey pot: Daily sum of the project’s Total Value Locked (TVL) since launch. For standardization purposes, this value is divided by $365B ($1B per day for 365 days) to arrive at the Honey Pot coefficient.

- Audits quality (Qualitative): Thoroughness and quality of audits performed on the project.

- Quality of smart contracts (Qualitative): Measures the overall riskiness of the smart contracts. Evaluates the use of best practices, the thoroughness of the tests and the documentation, among other factors.

Counterparty Risk:

- Team (Qualitative): Evaluates the reputation and integrity of the team behind the project.

- Key contracts centralization (Qualitative): Measures the level of centralization of the most important contracts of the protocol.

Scoring Methodology

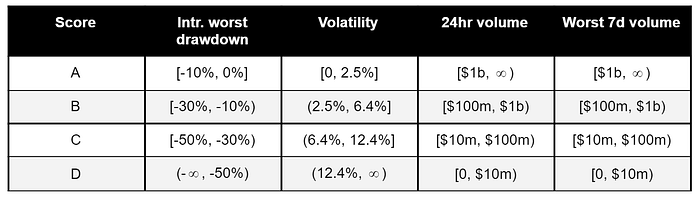

Each asset will receive a score from A to D in the relevant variables for each category according to the following tables:

Market Risk:

Smart Contract Risk:

Counterparty Risk:

* Since there’s more subjectivity and nuance involved in assessing these qualitative variables, we only define the conditions for the highest (A) and lowest (D) scores. Anything in between will be scored on a case by case basis according to the asset’s positioning between these 2 points.

After determining the score for each variable within each category, a final numeric score per category is computed. This score will be the average score of each of the category’s variables, according to the following table:

Example of a Market Risk Score Calculation

Let Asset A have the following scores for the Market Risk variables:

- Intraday worst drawdown: A

- Volatility: B

- 24hr volume: C

- Worst 7d volume: B

Then, the final numeric score for this asset would be:

Risk Parameters

Before defining the risk parameters methodology, it’s worth exploring what the risk parameters are:

- Loan-to-Value (LTV): Determines the maximum amount a user can borrow with a certain collateral. For example, if the LTV of an asset is 50%, a user who deposits 1,000 UST worth of that asset will be able to borrow up to 500 UST worth of any asset available on the platform. Given that a user can deposit multiple assets as collateral, the total LTV for a user can be calculated as follows:

- Liquidation Threshold: Determines the level at which a loan is considered to be undercollateralized and can be liquidated. For example, if the Liquidation Threshold of a position is 70% and the value of the borrowed assets for that position increases to over 70% of the value of the collateral, the position can be liquidated. The liquidation threshold will always be higher than the LTV for every asset. This serves as a margin of safety for borrowers. The Liquidation Threshold per user can be calculated as follows:

- Liquidation Bonus: Determines the bonus the liquidator receives when it liquidates a position. This bonus is paid from the collateral of the user that gets liquidated. For example, if the liquidation bonus is 15%, liquidators receive an additional 15% of the borrower’s collateral for every unit of debt repaid.

- Optimal utilization: Determines the optimal ratio of borrowed vs. deposited assets for a given money market. For example, if the optimal utilization of a market is 80%, then at the optimal utilization level the amount of assets borrowed from that market should be 80% of the assets deposited into that market.

- Exposure Limit: Mars will set a deposit limit to certain assets based on their risk profile. This cap will serve as a protection mechanism that allows newer (and potentially riskier) assets to be added to the platform without sacrificing the overall integrity of the system. Whenever an asset hits its exposure limit, its LTV automatically becomes 0. This means that at that point the asset won’t be accepted any longer as collateral within Mars, thus limiting the exposure of the platform to that asset.

- Collateral (Binary): Indicates whether an asset can be used as collateral within the platform. Some assets that fall into a specific risk profile may be allowed to be deposited in the platform and made available for borrowing, but they wouldn’t be usable as collateral.

- Kp (controller proportional term): Defines how quickly the interest rate reacts to changes in utilization. This parameter varies from market to market depending on two main factors — the overall risk rating and the responsiveness of the asset. Two values of Kp need to be defined: Kp1 for normal conditions and Kp2 to be used in extreme conditions. Normal conditions refer to situations where utilization is within a 20 percentage point range from the optimal utilization. In situations where that’s not the case, Kp2 will be used such that interest rates adjust more aggressively.

As mentioned before, the scoring methodology explored in the previous section is the most important input for determining the risk parameters per asset. While all categories are relevant to determine every risk parameter, we use different weights for each category depending on the parameter we’re defining.

For liquidation-related parameters (LTV, Liquidation Threshold and Liquidation Bonus), for instance, we weigh Market Risk more heavily, since we believe that once an asset is included in the platform, most of the liquidation risk comes from challenging market conditions, which are incorporated into the Market Risk category. SC and CP risk, on the other hand, are risks that can materialize in a more binary way. As such, we give them more importance when determining the Exposure Limit and the Collateral, as those parameters limit the overall exposure of the platform to a certain asset in a more direct way.

The specific details of how we set each of these parameters will be explored in detail in the following sections.

LTV, Liquidation Threshold and Liquidation Bonus

These parameters will be determined as follows:

First, the LTV is computed:

LTV = Max. LTV * Weighted Score, where:

Max. LTV = 90%, which indicates the maximum LTV given to A assets in the platform.

Weighted Score = 0.7 (Market Risk Score) + 0.15 (SC Risk Score) + 0.15 (CP Risk)

Then, the Liquidation Threshold and Liquidation Bonus are calculated as follows:

Any asset with a Weighted Score below 0.25 won’t be included in the platform.

Optimal Utilization

Based on the same Weighted Score used in the previous section, the initial optimal utilization values will be determined as follows:

Given that the optimal utilization is a critical parameter for the interest rate model, real utilization will be closely monitored once markets are live and optimal utilization will be updated accordingly in cases where it’s needed.

Exposure Limit

The exposure limit will be determined as follows:

First, a Weighted Score is calculated.

Weighted Score = 0.2 (Market Risk Score) + 0.4 (SC Risk Score) + 0.4 (CP Risk)

After calculating the Weighted Score, the exposure limit is determined according to the following table:

Note: The exposure limit will be implemented on Mars v2.

Collateral (Binary)

Not every asset accepted on Mars will be available for use as collateral. Specifically, assets with high counterparty risk (D score in both CP variables) won’t be accepted as collateral.

Kp (controller proportional term)

The main criteria to set Kp1 and Kp2 is the responsiveness of the market to changes in the interest rate. The lower the responsiveness, the lower the Kp in order to avoid drastic changes in interest rates within those markets and vice versa. To determine the responsiveness of each asset, a qualitative assessment was performed to estimate demand for that asset within the protocol. The initial set of parameters will be set on the conservative side. Once enough empirical data is available, a quantitative methodology will be developed to complement this qualitative approach.

Conclusion

The Mars Risk Framework is critical to ensuring Mars is safe for all participants. By standardizing the way we analyze risk parameters, we can compare assets quickly and objectively. We can also avoid the potentially political process of choosing which assets get supported.

The Risk Framework scores all assets on a spectrum. The riskier an asset is, the greater the limitations the protocol imposes on that asset. For example, riskier assets have higher liquidation bonuses and lower optimal utilization targets. In that way, it allows the protocol to support riskier assets without jeopardizing the overall health of the protocol.

Risk scores will initially be calculated by core team members. However, that process will eventually be opened up to the community. Any MARS staker will be able to score and propose adding any new asset to Mars.

In this way, the Risk Framework moves us closer to our goal of completely decentralizing Mars while ensuring it’s capable of evolving with the wider crypto landscape.

Join the mission

Share your comments below or follow us on Twitter at twitter.com/mars_protocol